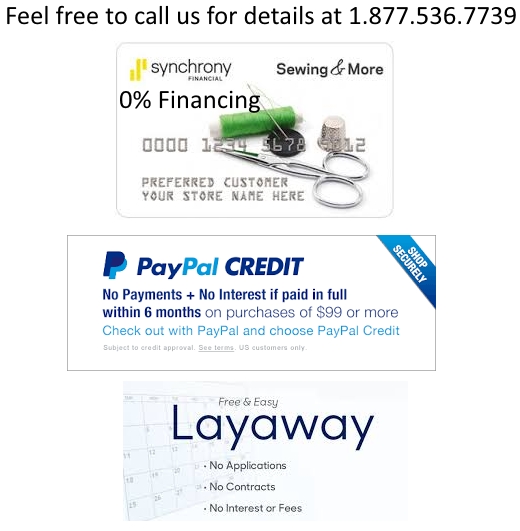

Financing Available

CURRENT FINANCING SPECIALS FROM OUR VENDORS

ATTENTION SYNCHRONY ACCOUNT HOLDERS AND THOSE APPLYING FOR SEWING AND MORE ACCOUNTS

When applying for a Synchrony account please make sure to enter your billing and shipping address just as appears on all your drivers license.

When approved for a Synchrony account this information needs to be entered exactly as you have on your application when on our checkout page. If it is not entered exactly as you entered on your

application then Synchrony will decline or cancel the order. This is due to fraud prevention and making sure we have the best address to send your order to.

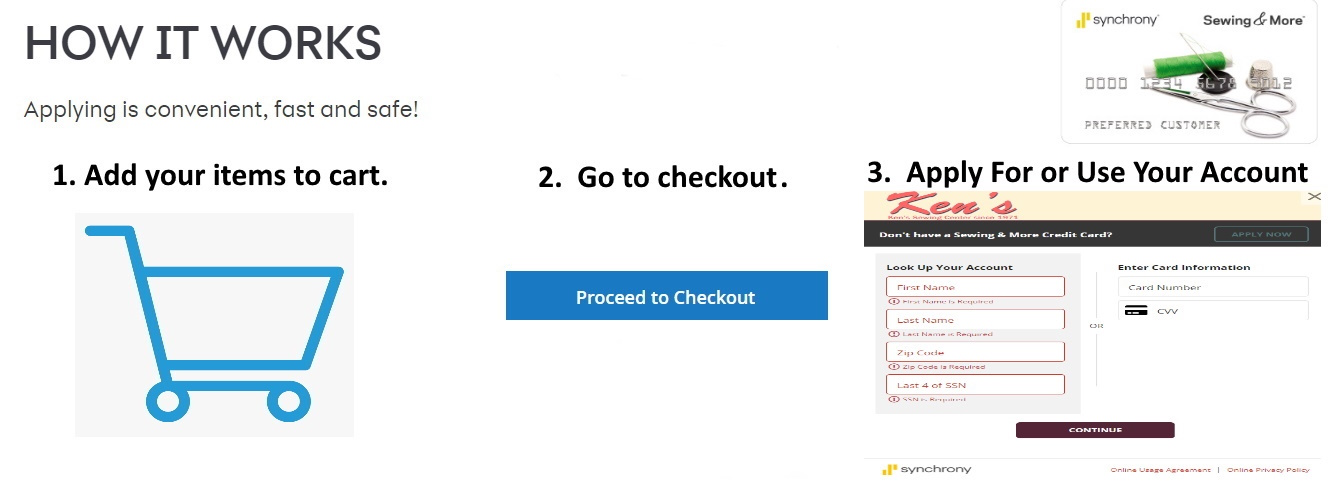

Ken's Sewing & Vacuum Center is proud to offer easy financing thru Synchrony. Buy now and pay later with monthly financing plans. Now you can apply onine, place your order and pay online. Just place the items you want to purchase in your card and go to checkout. You will have the option to choose Synchony as you payment method. Then you will be able to apply for a Sewing & More Card and finish your order.

It is Fast & Easy!

No Interest if paid in full within 6 months *

On qualifying purchases of $150 to $1,999.99 made with your Sewing & More credit card. Interest will be charged to your account from the purchase date if the promotional balance is not paid in full within 6 months. Minimum monthly payments required.

No Interest if paid in full within 12 months*

On qualifying purchases of $2,000 to $2,999.99 made with your Sewing & More credit card. Interest will be charged to your account from the purchase date if the promotional balance is not paid in full within 12 months. Minimum monthly payments required.

No Interest if paid in full within 18 months*

On qualifying purchases of $3,000 to $3,999.99 made with your Sewing & More credit card. Interest will be charged to your account from the purchase date if the promotional balance is not paid in full within 18 months. Minimum monthly payments required.

*Offer applies only to single-receipt qualifying purchases. No interest will be charged on the promo balance if you pay it off, in full, within the promo period. If you do not, interest will be charged on the promo balance from the purchase date. The required minimum monthly payments may or may not pay off the promo balance before the end of the promo period, depending on purchase amount, promo length and payment allocation. Regular account terms apply to non-promo purchases and, after promo period ends, to the promo balance. For New Accounts: As of 05/01/24: Purchase APR is 29.99%. Minimum Interest Charge is $2. As of 07/16/24: Purchase APR 34.99%. Penalty APR 39.99%. Min Interest Charge $2. A promo fee will be charged equal to 2% of the amount financed on an equal payment no interest promotion of 18 months or more. Existing cardholders: See your credit card agreement terms. We reserve the right to discontinue or alter the terms of this offer at any time. Subject to credit approval.

No Interest with 24 equal monthly payments**

On qualifying purchases of $4,000 or more made with your Sewing and More credit card. Promo fee of 2% of amount financed will be included in required monthly payments.

**Qualifying purchase amount must be on one receipt. A promo fee, equal to 2% of the amount financed at time of purchase, will be shown as a separate transaction on your billing statement and included in the balance subject to this promo. Any taxes, delivery or other charges included in the amount financed will increase the related promo fee and the required monthly payments. For example, a $950 purchase with $50 in taxes and shipping costs, will be charged a promo fee equal to $20 and $1,020 will be charged to your account. No interest will be charged on the amount financed (including related promo fee), and equal monthly payments are required on such balance until it is paid in full. The payments equal the amount financed (including related promo fee) divided by the number of months in the promo period, rounded up to the next cent. These payments may be higher than the payments that would be required if this purchase was a non-promo purchase. During the last month(s) of the promo period the required monthly payment may be reduced due to the prior months' rounding. Regular account terms apply to non-promo purchases. New Accounts as of 7/16/24: Purchase APR 34.99%. Penalty APR 39.99%. Min Interest Charge $2. Existing cardholders: See your credit card agreement terms. Subject to credit approval.

5.99% APR with fixed monthly payments for 36 months+

On qualifying purchases of $6,000 or more made with your Sewing and More credit card. Fixed monthly payments required for 36 months.

+Qualifying purchase amount must be on one receipt. A promo fee does not apply to this offer. Interest will be charged on the promo purchase, including related optional debt cancellations fees, from the purchase date at a reduced 5.99% APR, and fixed monthly payments are requirement until paid in full. These payments are equal to 3.0417% of initial total promo purchase amount, rounded up to the next whole cent. These payments may be higher than the payments that would be required if this purchase was a non-promo purchase. During the last month(s) of the promo period the required monthly payment may be reduced due to the prior months' rounding. Regular account terms apply to non-promo purchases. New Accounts as of 7/16/24: Purchase APR 34.99%. Penalty APR 39.99%. Min Interest Charge $2. promo fee will be charged equal to 2% of the amount financed on an equal payment no interest promotion of 18 months or more. Existing cardholders: See your credit card agreement terms. Subject to credit approval

5.99% APR with fixed monthly payments for 48months++

On qualifying purchases of $8,000 or more made with your Sewing and More credit card. Fixed monthly payments required for 48 months.

++Qualifying purchase amount must be on one receipt. A promo fee does not apply to this offer. Interest will be charged on the promo purchase, including related optional debt cancellations fees, from the purchase date at a reduced 5.99% APR, and fixed monthly payments are requirement until paid in full. These payments are equal to 2.3480% of initial total promo purchase amount, rounded up to the next whole cent. These payments may be higher than the payments that would be required if this purchase was a non-promo purchase. During the last month(s) of the promo period the required monthly payment may be reduced due to the prior months' rounding. Regular account terms apply to non-promo purchases. New Accounts as of 7/16/24: Purchase APR 34.99%. Penalty APR 39.99%. Min Interest Charge $2. promo fee will be charged equal to 2% of the amount financed on an equal payment no interest promotion of 18 months or more. Existing cardholders: See your credit card agreement terms. Subject to credit approval

5.99% APR with fixed monthly payments for 60 months^

On qualifying purchases of $10,000 or more made with your Sewing and More credit card. Fixed monthly payments required for 60 months.

^Qualifying purchase amount must be on one receipt. A promo fee does not apply to this offer. Interest will be charged on the promo purchase, including related optional debt cancellations fees, from the purchase date at a reduced 5.99% APR, and fixed monthly payments are requirement until paid in full. These payments are equal to 1.9328% of initial total promo purchase amount, rounded up to the next whole cent. These payments may be higher than the payments that would be required if this purchase was a non-promo purchase. During the last month(s) of the promo period the required monthly payment may be reduced due to the prior months' rounding. Regular account terms apply to non-promo purchases. New Accounts as of 7/16/24: Purchase APR 34.99%. Penalty APR 39.99%. Min Interest Charge $2. promo fee will be charged equal to 2% of the amount financed on an equal payment no interest promotion of 18 months or more. Existing cardholders: See your credit card agreement terms. Subject to credit approval

5.99% APR with fixed monthly payments for 72 months^^

On qualifying purchases or $11,500 or more made with your Sewing and More credit card. Fixed monthly payments required for 72months.

^^Qualifying purchase amount must be on one receipt. A promo fee does not apply to this offer. Interest will be charged on the promo purchase, including related optional debt cancellations fees, from the purchase date at a reduced 5.99% APR, and fixed monthly payments are requirement until paid in full. These payments are equal to 1.6568% of initial total promo purchase amount, rounded up to the next whole cent. These payments may be higher than the payments that would be required if this purchase was a non-promo purchase. During the last month(s) of the promo period the required monthly payment may be reduced due to the prior months' rounding. Regular account terms apply to non-promo purchases. New Accounts as of 7/16/24: Purchase APR 34.99%. Penalty APR 39.99%. Min Interest Charge $2. promo fee will be charged equal to 2% of the amount financed on an equal payment no interest promotion of 18 months or more. Existing cardholders: See your credit card agreement terms. Subject to credit approval

When applying for financing please consider the following:

Many times it is best to apply with a joint applicant such as your spouse or other family member. Please be sure to fill in all blanks so your application is processed quickly and efficiently.

If you are retired or work from home please include your home phone number and include all reportable income in the space provided on the application.

Feel free to contact us today for more information at 1.877.536.7739.

Financing Rates with Syncrony Bank based on posted prices on our website. Coupon codes, rebates and discounts cannot be applied to financed orders.

*On qualifying purchases made with your Syncrony Card. Call for more details on financing terms and conditions. Financing applies to select items before tax.

*On qualifying purchases made with your Syncrony Card. Call for more details on financing terms and conditions. Financing applies to select items before tax. ATTENTION SYNCHRONY ACCOUNT HOLDERS AND THOSE APPLYING FOR SEWING AND MORE ACCOUNTS

When applying for a Synchrony account please make sure to enter your billing and shipping address just as appears on all your drivers license.

When approved for a Synchrony account this information needs to be entered exactly as you have on your application when on our checkout page. If it is not entered exactly as you entered on your

application then Synchrony will decline or cancel the order. This is due to fraud prevention and making sure we have the best address to send your order to.

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

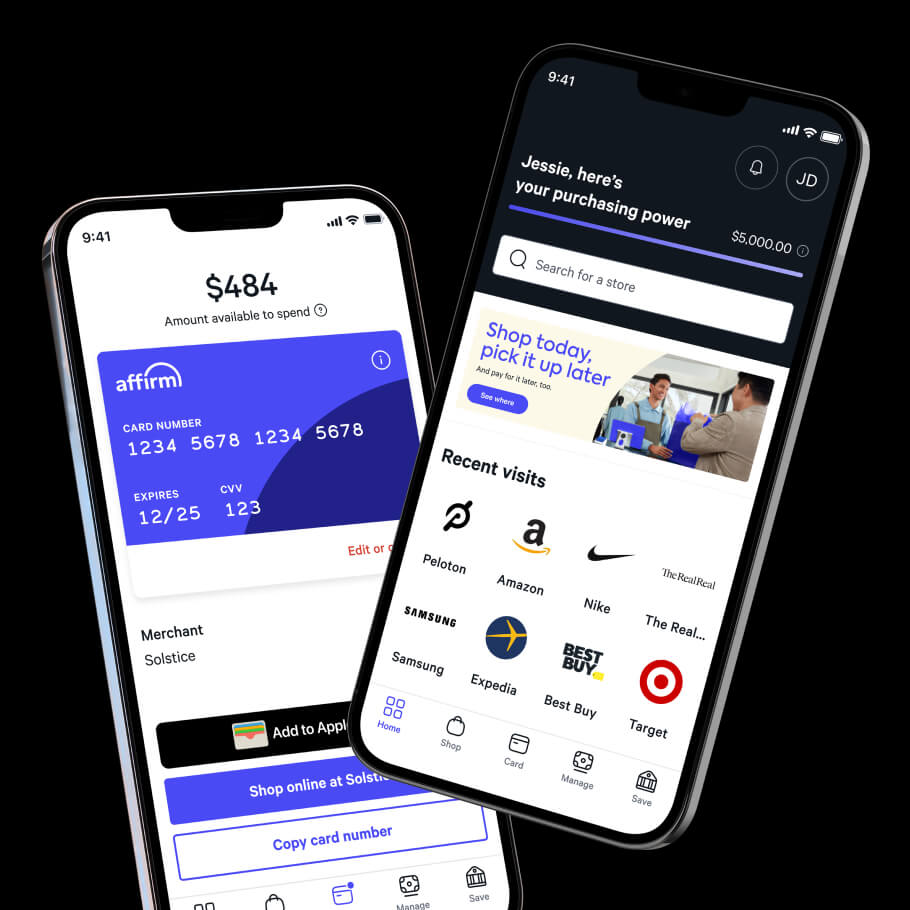

https://www.affirm.com/

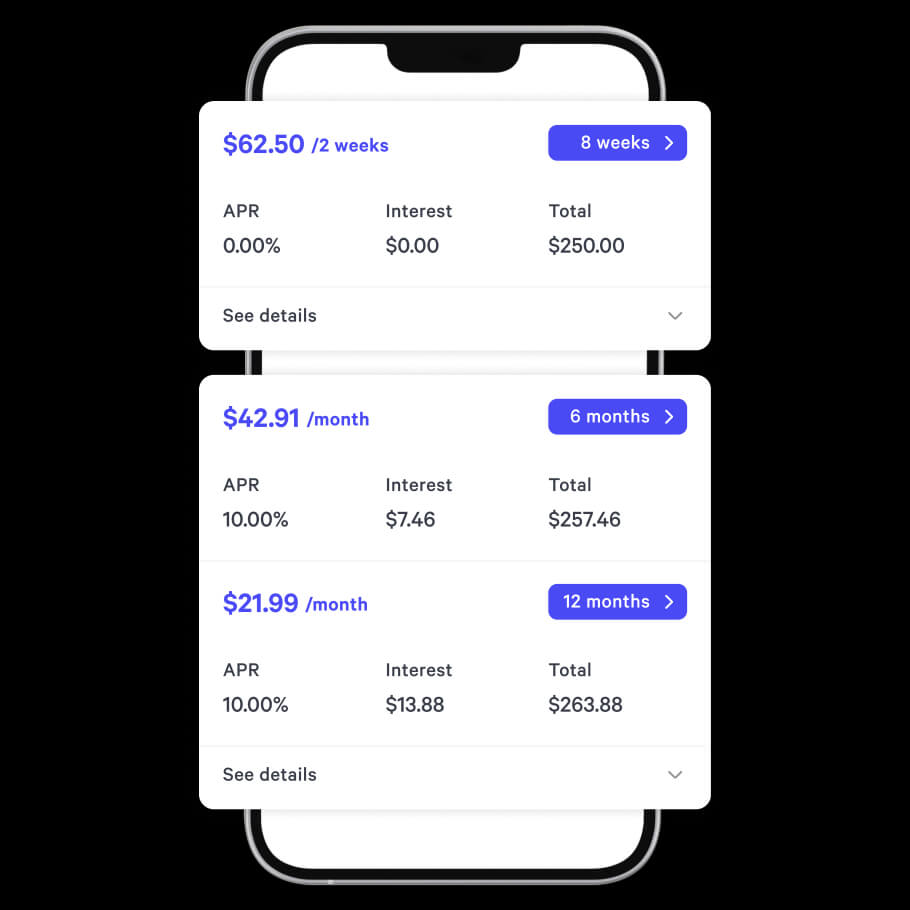

Your rate for pay-over-time plans will be 0–36% APR. Affirm Pay in 4 payment option is 0% APR. Payment options through Affirm are subject to an eligibility check and may not be available everywhere. Options depend on your purchase amount, and a down payment may be required. For example, a $800 purchase might cost $72.21/mo over 12 months at 15% APR or 4 interest-free payments of $200 every 2 weeks.

Payment options through Affirm are provided by these lending partners: affirm.com/lenders. For licenses and disclosures, including information for New Mexico residents, see affirm.com/licenses. CA residents: Loans by Affirm Loan Services, LLC are made or arranged pursuant to a California Financing Law license.

Lending (e.g., payment plans)

Your rate for pay-over-time plans will be 0–36% APR. Affirm Pay in 4 payment option is 0% APR. Payment options through Affirm are subject to an eligibility check and may not be available everywhere. Options depend on your purchase amount, and a down payment may be required. For example, a $800 purchase might cost $72.21/mo over 12 months at 15% APR or 4 interest-free payments of $200 every 2 weeks.

Payment options through Affirm are provided by these lending partners: affirm.com/lenders. For licenses and disclosures, including information for New Mexico residents, see affirm.com/licenses. CA residents: Loans by Affirm Loan Services, LLC are made or arranged pursuant to a California Financing Law license.

Purchasing Power

Estimate of how much you can spend with Affirm, it is subject to change and approval is not guaranteed. Rates from 0-36% APR. Payment options through Affirm are subject to an eligibility check, may not be available everywhere, and are provided by these lending partners: affirm.com/lenders. Options depend on your purchase amount, and a down payment may be required. Estimated payment amount may exclude taxes and shipping. For licenses and disclosures, including information for New Mexico residents, see affirm.com/licenses. CA residents: Loans by Affirm Loan Services, LLC are made or arranged pursuant to a California Financing Law license.

For more information, see Help Center.

Affirm Card

The Affirm Card is a Visa® debit card issued by Evolve Bank & Trust, Member FDIC, pursuant to a license from Visa U.S.A. Inc. You must request and be approved to get the Card. Getting the Card does not guarantee the ability to pay over time. You must apply for pay-over-time plans for each purchase in the mobile app. Pay-over-time plans are subject to eligibility checks and are provided by affirm.com/lenders. A minimum purchase of $50 is required to pay over time. For pay in full purchases, including purchases that are not approved for and matched to pay-over-time plans, you authorize one or more electronic debits from your linked bank account for up to the total amount of all pay in full purchases made on your Card since the last successful debit was initiated. Funds will pull from your Affirm Money Account, or external linked bank account within 1-3 days of the purchase.

Your rate for pay-over-time plans will be 0%–36% APR based on credit. Affirm Pay in 4 payment option is 0% APR. Options depend on your purchase amount, may vary by merchant, may depend on whether your loan is applied for before or after your Card purchase, and may not be available everywhere. A down payment may be required. Estimated payment amount may exclude taxes and shipping. For licenses and disclosures, including information for New Mexico residents, see affirm.com/licenses. CA residents: Loans by Affirm Loan Services, LLC are made or arranged pursuant to a California Financing Law license.

For more information, see https://www.affirm.com/card.

Affirm Money Account

Affirm is a financial technology company, not a bank or an FDIC-insured depository institution. The Affirm Money Account is FDIC insured up to the federal limit of $250,000 through our partner bank, Cross River Bank, Member FDIC (CRB). The federal limit applies to all money held by you at CRB, and FDIC insurance will only cover the failure of CRB. The Annual Percentage Yield (APY) is effective as of 8/18/2023 and may change at any time after account opening. No minimum balance is required to open an account or receive the advertised APY. Early access to direct deposit funds depends on the timing of the payment file from the payer and is not guaranteed.

For more information, see https://www.affirm.com/money.

The choice is yours

Affirm Pay in 4

Make 4 interest-free payments every 2 weeks. Great for everyday purchases.

-

No interest or fees

-

checking eligibility has no impact to credithecking eligibility has no impact to credit

-

Set up easy, automatic payments

Monthly payments

Choose monthly installments. Perfect for big-ticket items.

-

No hidden fees—ever

-

What you see is what you pay

-

Set up easy, automatic payments

We keep it simple

When you can choose a payment option that suits your budget, it’s easy to get that interview outfit or go on your dream vacation.

We never charge fees

You'll never pay late fees. Or annual fees. Or hey-it's-a-random-day-in-April fees.

We tell it like it is

With credit cards, the longer you take to pay off your balance, the more expensive your purchase becomes. With Affirm, you always know exactly what you'll owe and when you'll be done paying off your purchase.

Transparent

We tell you up front the total amount you’ll pay. That number will never go up.

You choose the payment schedule that works for you.

You’ll never pay late fees, penalties, or hidden interest, ever.

How to buy with Affirm

You’ll see us at checkout, or you can request a virtual card in the Affirm app.

Choose your payment terms

You’re in control. Pick the payment option that works for you and your budget—from 4 interest-free payments every 2 weeks to monthly installments.

Make your payments

Manage your payments in the Affirm app or online, and set up AutoPay so you don’t miss a payment. But if you do, you’ll never pay any fees.

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

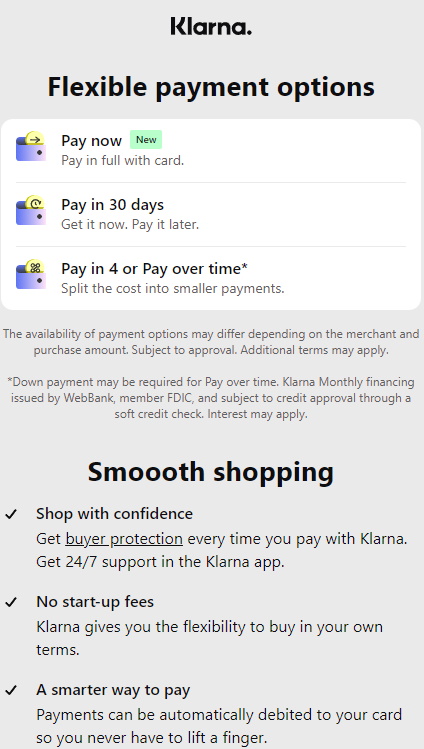

Pay how you like. Enjoy the flexibility to get what you want and pay over time.

Pay in 4 with Klarna through our app, with integrated brands, or anywhere Visa is accepted.

No credit impact. Our instant approval process has zero impact on your credit score.

Pay later shopping.

Millions of people have discovered the benefits of online shopping with Klarna payment plans. Try before you buy, or pay over time. No matter what you need, we've got a flexible option to fit your budget.

We also offer free layaway on any item we sell. Our layaway plan is very easy to use.

Here's how our Layaway Program works:

- Make a 10% down payment on the item(s) you wish to purchase.

- Make payments for the item(s) as you wish during the 3-month layaway period.

- When the final payment is made, we ship the item to you.

- There are no fees or interest to pay for using our layaway program.

- If you have to cancel a layaway, we do not refund layaway payments but will allow you to apply what you have paid to other merchandise in our store.

The Layaway Program is a free service we offer to our customers. We also have other payment plans.

Please call us for more details.

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Clicklease is a front runner in delivering commercial point-of-sale solutions to the commercial equipment finance market. Archaic systems and business practices have slowed adoption of digitalization and automation in this mature industry, creating a unique opportunity for disruption. Focused on helping undeserved businesses get the equipment they need to succeed, clicklease operates in the micro-ticket space, instantly decisioning and funding capital investments that produce a direct and immediate impact for these small business owners. Through innovation and automation clicklease delivers simple, fast and competitive financing solutions to entrepreneurs and their main street businesses. To learn more call Ken's staff at 1.877.536.7739.